Over three quarters (76%) of first-time buyers’ mortgage applications via intermediaries resulted in a completion during Q1 2018, according to the latest Mortgage Market Tracker from the Intermediary Mortgage Lenders Association (IMLA), the highest number since the Tracker began in 2016.

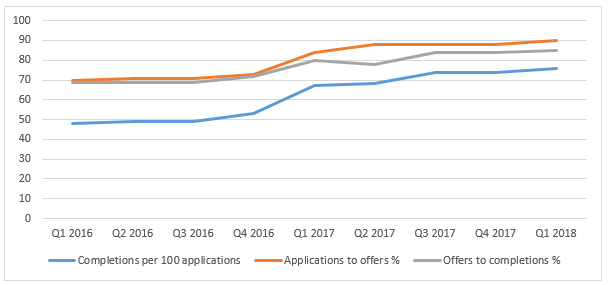

This quarter’s figures compare with just under half of first-time buyers securing a mortgage (48%) in Q1 2016, rising to 76% in Q1 2017.

In contrast, the number of home movers making successful mortgage applications decreased by three percentage points over the quarter, as record low market liquidity and a lack of affordable housing continues to affect existing homeowners’ ability to move readily.

The quarterly IMLA report – which uses data from BDRC Continental – examines consumers’ success rate in securing a mortgage via the intermediary channel, by tracking their progress from initial expression of interest (seeking a ‘decision in principle’ ) through to completion. In doing so, it compares the fortunes of first-time buyers, home movers, remortgagors, buy-to-let (BTL) borrowers and applicants for specialist loans.

UK Finance data recently showed that first-time buyer numbers reached a ten-year high in 2017 , with lending to this group continuing to increase year-on-year throughout the first three months of 2018.

IMLA’s Tracker suggests that this was helped by nine in ten (90%) applicants securing a mortgage offer in Q1 2018 for the fourth successive quarter, up from 70% two years earlier. More than four in five (85%) of those offers in Q1 2018 went on to complete, compared to 69% in Q1 2016.

Chart 1: Progress of first-time buyer mortgage applications to offers and completions

The number of first-time buyers has increased in recent years to reach 366,000 in 2017, driven by factors including cash inheritances, the ‘Bank of Mum and Dad’ helping to supplement deposits and government schemes such as Help to Buy, which have helped aspiring homeowners make their first step onto the ladder. IMLA’s data suggests first time buyers’ fortunes have improved more than any category of borrower in the last two years.

For every 100 applications, an additional 28 first-time buyers completed on a mortgage in Q1 2018 compared with Q1 2016 (76 vs. 48).

However, homeowners looking to make subsequent moves are feeling the effects of an illiquid market. Despite 375,200 ‘steppers’ making a move on the housing ladder in 2017, this is down 43% since 2007, as many struggle to meet stricter mortgage affordability criteria on their next homes, despite significant equity gains on many properties. The stagnant housing market means that UK homeowners now only move once every 19.2 years vs 7.4 years in 1988, a result of a number of factors including high transaction costs, homeowners getting older and greater opportunities for people to draw upon the equity of their homes to fund retirement. Lack of suitable housing (which may vary from retirement developments to high-quality, large apartments or low-rise housing and bungalows) may also be deterring some owners of larger properties from moving – whether they wish to downsize or “differently” size, so that they retain a similar amount of equity in property but in a more practical and manageable home.

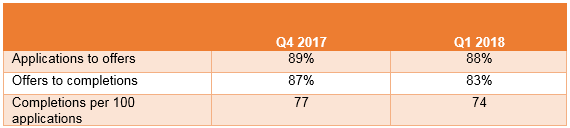

The number of home movers making successful mortgage applications decreased by three percentage points from Q4 2017, from 77% to 74%. This represents a change in fortunes for the first time since the Tracker began, with the previously upward trend in successful homeowner applications moving from 64% in Q1 2016 and 72% in Q1 2017 to reach 77% in Q4 2017.

Table 2: Number of successful mortgage applications by home movers declines in Q1

Kate Davies, Executive Director of IMLA, comments

“First-time buyers’ struggles have been highly publicised, with affordability stretched by house price inflation and modest income growth. Yet rising levels of mortgage enquiries, applications and completions shows that first-time buyers remain interested, able and willing to get a foot on the property ladder, with this customer group performing better than any other in the mortgage market, both in the short-term and on an annual basis.

“As well as competitively priced and widely-available deals, many first-time buyers owe their success to initiatives such as the Help to Buy scheme, LISAs and stamp duty relief. However, this continued focus on first-time buyers has come at the expense of the rest of the market, which is becoming increasingly illiquid.

“The government’s commitment to improving access to the housing ladder has gone some way to increasing our supply of new and affordable homes – for example, nearly half (43%) of new build properties are currently a result of the Help to Buy scheme. However, while a significant number of aspiring homeowners have benefitted from these initiatives, many home movers, or ‘steppers’ continue to struggle with hurdles including high house prices relative to earnings, stricter mortgage affordability criteria and a lack of suitable homes.

“Recognition and support from both policy makers and lenders is needed for this group, to improve housing turnover and transaction volumes in the wider market. The government should take this pivotal juncture as an opportunity to reassess where in the market injections of new homes are needed: working with developers, planners and lenders to ensure the whole market is well-served.”

For further information please contact:

Fran Hart / Amy Boekstein, Instinctif Partners

Tel: 0207 427 1400

Email: imla@instinctif.com

Notes to Editors

Methodology

The IMLA Mortgage Market Tracker uses data provided by BDRC Continental – the UK’s largest independent research consultancy – as part of its established Project Mercury, a continuous monitor of intermediary lender marketing effectiveness and broker sentiment since 2007.

The Q1 2018 findings are based on interviews between January and March with 300 intermediaries who are located in Great Britain, arrange a minimum of 24 mortgages per annum and are not tied wholly to a single lender. Findings are weighted by firm size and type to be representative of the intermediary sector.

Adjustments to the methodology since the pilot edition (Q3 2015) mean comparisons should not be made prior to Q1 2016. Additional adjustments to various stages of the Tracker in Q2 2017 mean that quarterly and yearly comparisons can only be made on the ‘application to offer’ and ‘offer to completion’ points in the process.

About IMLA

The Intermediary Mortgage Lenders Association (IMLA) is the trade association that represents mortgage lenders who lend to UK consumers and businesses via the broker channel. Its membership of 52 banks, building societies and specialist lenders include 18 of the 20 largest UK mortgage lenders (measured by gross lending) and account for about 90% of mortgage lending (91.6% of balances and 92.8% of gross lending).

To keep up to date about IMLA in the news, our reports and other announcements, follow us on LinkedIn.