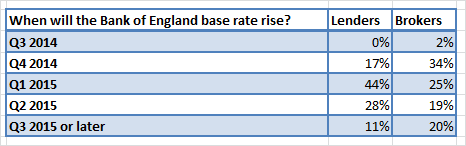

The latest findings from IMLA’s ‘Intermediary Lending Outlook’ research shows opinion is divided in the mortgage industry on the widely anticipated rate rise, with just 17% of lenders anticipating a hike during 2014.

The consensus among lenders is that the Bank of England will raise its base rate from 0.5% in the first half of 2015, for the first time since March 2009. Nearly three in four (72%) take this view including nearly half (44%) who expect to see a rise in Q1 2015. There is a greater split among brokers, with 44% predicting the rise will come in the first half of 2015 while one in five (20%) expect the 0.5% base rate will survive past the middle of next year.

Source: IMLA, July 2014.

Existing homeowners to feel the pinch the most?

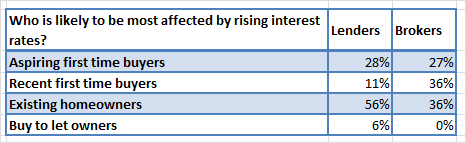

IMLA’s research also reveals diverging opinions across the mortgage industry about which group of borrowers will be most affected when the interest rate rise finally occurs.

The majority view among lenders (56%) is that existing homeowners will be the most affected demographic, followed by aspiring first time buyers (28% take this view). Just one in ten (11%) believe recent first time buyers will feel the biggest impact.

By comparison brokers expect recent first time buyers and existing homeowners will share the brunt of the interest rate rise, ahead of aspiring first time buyers. Both lenders and brokers agree that buy-to-let owners and landlords will be least affected by the eventual base rate rise.

Source: IMLA, July 2014. Numbers do not add up to 100% due to rounding

Peter Williams, Executive Director of IMLA, comments

“The prospect of a rise in interest rates has been looming on the horizon for some time, but now it appears an increase is hovering closely overhead. The majority view across the mortgage industry is that a rise in 2015 still looks to be the most likely outcome. But it won’t be long before the consensus is challenged within the MPC, and speculation over an early rise has clearly registered with a significant number of brokers.

“The fact that lenders feel recent first time buyers will be spared the impact of rising rates is an encouraging sign that stress tests implemented under the Mortgage Market Review are doing their job and will ensure that borrowers are financially prepared for higher interest payments.

“Brokers will have a vital role to play in the months ahead as existing homeowners review their current deals and look to ensure they are on the most favourable rates for their personal circumstances. It’s important to remember that the first rate rise in more than five – or potentially even six – years will seem like a momentous occasion when it arrives, but the size of increase is likely to be very modest, certainly to begin with. The Bank is firmly focused on cautious steps that will preserve the recovery and will guard against punishing existing borrowers.”

For further information please contact:

Andy Lane / Ludo Baynham-Herd, The Wriglesworth Consultancy

Tel: 0207 427 1400

Email: imla@wriglesworth.com

Notes to Editors

Methodology

The Intermediary Lending Outlook combines views from IMLA members – including senior representatives of banks, building societies and specialist lenders – and over 2,000 mortgage brokers from across the UK on conditions in the mortgage market since January 2012.

The latest wave of research saw 398 brokers surveyed independently by Wriglesworth Research in July 2014. IMLA’s membership comprises 22 lenders and accounts for over 70% of mortgage lending via intermediaries.

About IMLA

The Intermediary Mortgage Lenders Association (IMLA) is the trade association that represents mortgage lenders who lend to UK consumers and businesses via the broker channel. Its membership of 52 banks, building societies and specialist lenders include 18 of the 20 largest UK mortgage lenders (measured by gross lending) and account for about 90% of mortgage lending (91.6% of balances and 92.8% of gross lending).

To keep up to date about IMLA in the news, our reports and other announcements, follow us on LinkedIn.