Over half of UK homes will be rented by 2032 for the first time in sixty years if current housing trends go unchecked, according to a new report by IMLA (the Intermediary Mortgage Lenders Association) which assesses the growth of the buy to let (BTL) market and its impact on first time buyers.

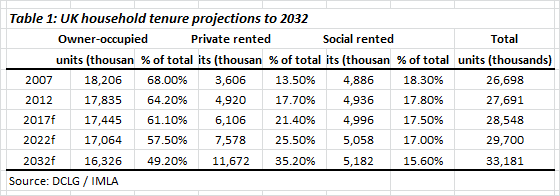

Since 2007 the private rented sector has grown from 14% to 18% of households while owner-occupation has dropped from 68% to 64% and social renting has also fallen.

This has happened with BTL mortgages financing just 420,000 (32%) of the additional 1.31m houses in the private rented sector since 2007, with the remainder made up of cash or commercially-funded purchases and properties rented out by their existing owners.

The IMLA report identifies multiple trends driving the rise of private renting by creating extra demand, including: the fall in social housing; growing obstacles to homeownership; changes in the employment landscape; greater numbers of students; high levels of immigration; later marriage and rising separation rates.

It emphasises that failing to increase UK housing supply in line with population and household growth is the major cause of first time buyer frustrations and the heightened sense of competition for buying homes. Low interest rates and quantitative easing have also advantaged landlords, with financial regulations such as limits on interest-only mortgages adding to the obstacles facing would-be homeowners.

Demographic projections point to rapidly rising housing demand, with the UK population expected to reach 67.8m by 2020 and 75.3m by 2035.

If current trends continue without a major policy or economic shift to address the shortage of new homes, the majority of UK households will be renting in the private and social sectors by 2032 for the first time since the early 1970s – with homeownership increasingly the preserve of the old.

The continuing fall in owner-occupation and decline of social renting would also mean more than a third of households renting privately within two decades – twice as many as today.

Homeownership is already lowest among younger generations and this effect will gradually move up the age brackets, as more people struggle to buy in their 30s and beyond. Between 1991 and 2012/13, homeownership among 16-24 year olds in England dropped from 36% to 11% while among 25-34s it fell from 67% to 40%.

Peter Williams, Executive Director of IMLA, comments

Proportion of households renting privately on course to double within two decades

For further information please contact:

Andy Lane / Rob Thomas, The Wriglesworth Consultancy

Tel: 0207 427 1400

Email: imla@wriglesworth.com

Notes to Editors

About IMLA

The Intermediary Mortgage Lenders Association (IMLA) is the trade association that represents mortgage lenders who lend to UK consumers and businesses via the broker channel. Its membership of 52 banks, building societies and specialist lenders include 18 of the 20 largest UK mortgage lenders (measured by gross lending) and account for about 90% of mortgage lending (91.6% of balances and 92.8% of gross lending).

To keep up to date about IMLA in the news, our reports and other announcements, follow us on LinkedIn.