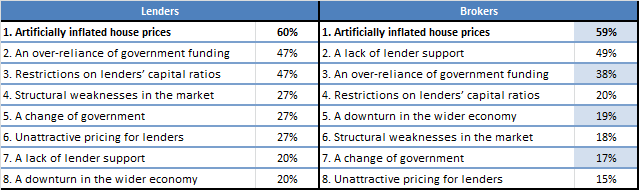

IMLA’s Intermediary Lending Outlook shows almost two thirds of intermediary lenders and brokers (60% and 59% respectively) single out a house price bubble as the most likely factor that may undermine the government scheme.

Scheme could spark a minimum 11% house price rise

The research shows lenders already anticipate a 2.7% increase in the average house price by the end of the year, pushing it to £166,418 according to the Land Registry measure*. Lenders’ prediction is based on the market’s performance in the first half of 2013 and the initial impact of the Help to Buy equity loan scheme.

If this same growth rate continues for the duration of Help to Buy, the average house price will reach £180,265 by the end of 2016: an overall rise of 11% in four years.

This would bring house prices close to their last peak of £181,975, which was recorded in November 2007. There are concerns that the rate of increase could be even greater with the upcoming Help to Buy mortgage guarantee offer still to launch in January 2014.

Lender support is crucial success factor

Brokers also register significant concerns about a potential lack of lender support for Help to Buy, with almost half worried this will jeopardise the scheme (49%).

Just one in five intermediary lenders openly share this sentiment (20%) yet almost half see capital weighting requirements as a major barrier to success (47%). The detail of capital relief is still to be confirmed by the Treasury and will greatly influence lenders’ ability to back the initiative.

The same proportion of the lending community is concerned that an over-reliance on government funding will handicap Help to Buy (47%), while more than a quarter cite structural weaknesses in the mortgage market (27%). This market imbalance is of as much concern as a change of government in the next general election (27%).

What are the biggest threats to the success of Help to Buy?

IMLA Intermediary Lending Outlook, August 2013

First time buyers set to benefit:

Despite these concerns both groups agree that first time buyers will see the greatest benefit from the upcoming Help to Buy mortgage guarantee: 100% of lenders and 89% of brokers took this view.

Lenders are more optimistic than brokers about home movers benefitting (80% vs. 56%). While the guarantees will also be available to existing homeowners seeking to move to another lender, just 13% of lenders and 6% of brokers see the scheme as benefitting homeowners remortgaging their properties.

*As measured by the Land Registry “House Price Index“:http://www.landregistry.gov.uk/public/house-prices-and-sales (£161,876 – January 2013)

Peter Williams, Executive Director of IMLA, comments

“Pleasing though it is to see increasing levels of activity in the market and a swell of consumer interest, these findings spell out the importance of keeping control over any future growth.

“There is a clear consensus that first-time buyers stand to benefit most from the second part of Help to Buy. But if house prices continue to rise for the duration of the scheme, then in essence we will be giving with one hand and taking away with the other. Moreover the exit from the scheme will need to be managed very carefully so it without causing serious harm to the market.

“If people are struggling to raise deposits in the current climate then a further 11% increase in house prices will lift the property ladder even further out of reach for some. House builders are attempting to bridge the ever growing chasm between supply and demand† which is going to be essential to ensure we help more people to access the property ladder without creating new hurdles in the form of inflated house prices.

“In the meantime, the pressure is on to ensure Help to Buy is more inclusive than divisive. Agreement on capital weightings and on the fee lenders will be charged to participate are crucial to ensuring the scheme is made affordable for lenders as well as consumers if we want to see a similar impact as the current equity loan scheme.

†The latest “house building statistics“:http://www.gov.uk/government/publications/house-building-in-england-april-to-june-2013 from the Department for Communities and Local Government (DCLG) show a 23.1% increase in new home starts between the first and second quarters of 2013

Notes to Editors

Methodology

Over 300 intermediaries from across the UK were surveyed independently by Wriglesworth Research on behalf of IMLA in July 2013. Among the respondents, 39% were Directly Authorised firms, 57% were Appointed Representatives and the remaining were unauthorised.

IMLA members were also surveyed independently by Wriglesworth Research, including senior representatives of banks, building societies and specialist lenders accounting for over 70% of mortgage lending via intermediaries.

About IMLA

The Intermediary Mortgage Lenders Association (IMLA) is the trade association that represents mortgage lenders who lend to UK consumers and businesses via the broker channel. Its membership of 52 banks, building societies and specialist lenders include 18 of the 20 largest UK mortgage lenders (measured by gross lending) and account for about 90% of mortgage lending (91.6% of balances and 92.8% of gross lending).

To keep up to date about IMLA in the news, our reports and other announcements, follow us on LinkedIn.